Market Structure

Fiscal Echoes, Credibility vs Fundamentals

Nov 7, 2025

Fiscal Echoes, Credibility vs Fundamentals

A structural read on how sovereign markets price trust once fundamentals stop explaining the spread.

Credibility is the last anchor in sovereign markets.

Yields can absorb volatility.

They can tolerate policy error.

What they cannot forgive is the loss of fiscal trust.

This Insight dissects how much of sovereign CDS remains tied to Debt–to–GDP once country fixed effects are stripped away. What is left is the credibility premium, the quiet wedge between what a country should pay and what markets actually demand.

Across the four figures below, the signal is consistent: fundamentals are fading, political tone is resurfacing, and valuation is drifting back toward narrative rather than arithmetic.

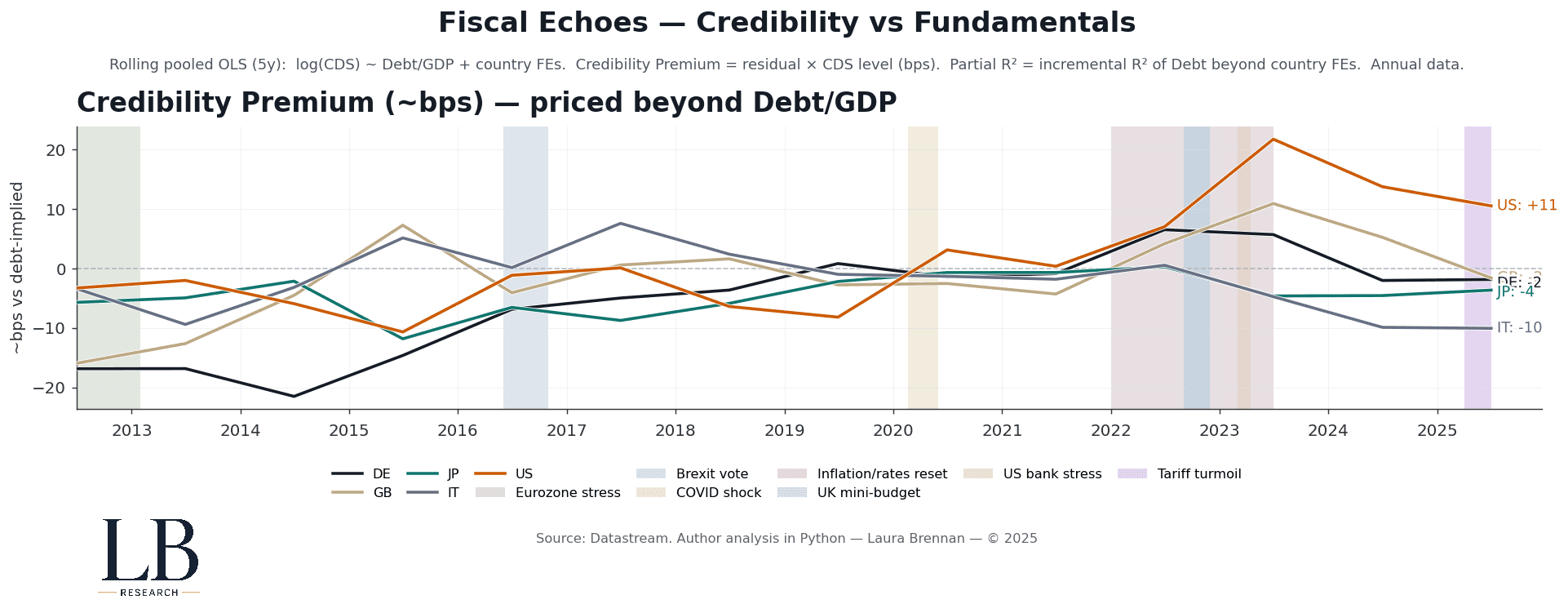

Credibility Premium (~bps), priced beyond Debt/GDP

The first figure isolates the residual spread after removing the mechanical influence of Debt/GDP. A positive premium implies trust beyond fundamentals. A negative premium implies a credibility discount.

The 2025 read-out highlights the asymmetry:

US: +10 bps still benefits from a structural trust buffer

GB: −2 bps flat to mildly discounted

DE: −2 bps stability priced in

JP: −4 bps long-standing structural discount

IT: −10 bps persistent credibility drag

Across the panel, the narrative is subtle but firm: investors still reward fiscal clarity, and they still penalise ambiguity. Credibility premia remain political long before they become mathematical.

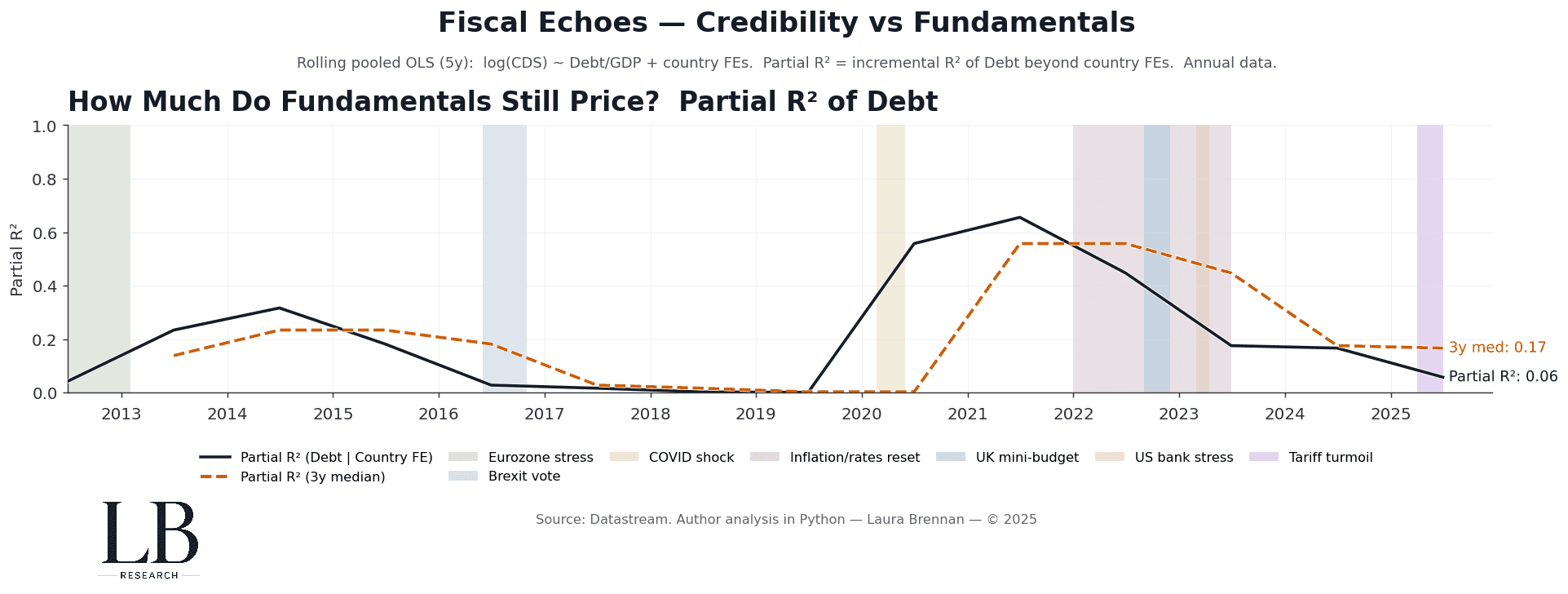

How Much Do Fundamentals Still Price? Partial R² of Debt

Here, the incremental explanatory power of Debt/GDP (beyond country effects) is measured through time.

The signal is stark:

Partial R² ≈ 0.06 for 2025

3-year median ≈ 0.17

This is the lowest explanatory power of fundamentals since the mid-2010s.

When partial R² falls, fundamentals lose influence.

Pricing migrates to policy tone, regime signals, and perceived fiscal direction.

Markets stop asking “What is the debt level?”

And start asking “Do we trust the state running it?”

This is the inflection point where valuation drifts quietly before anything breaks.

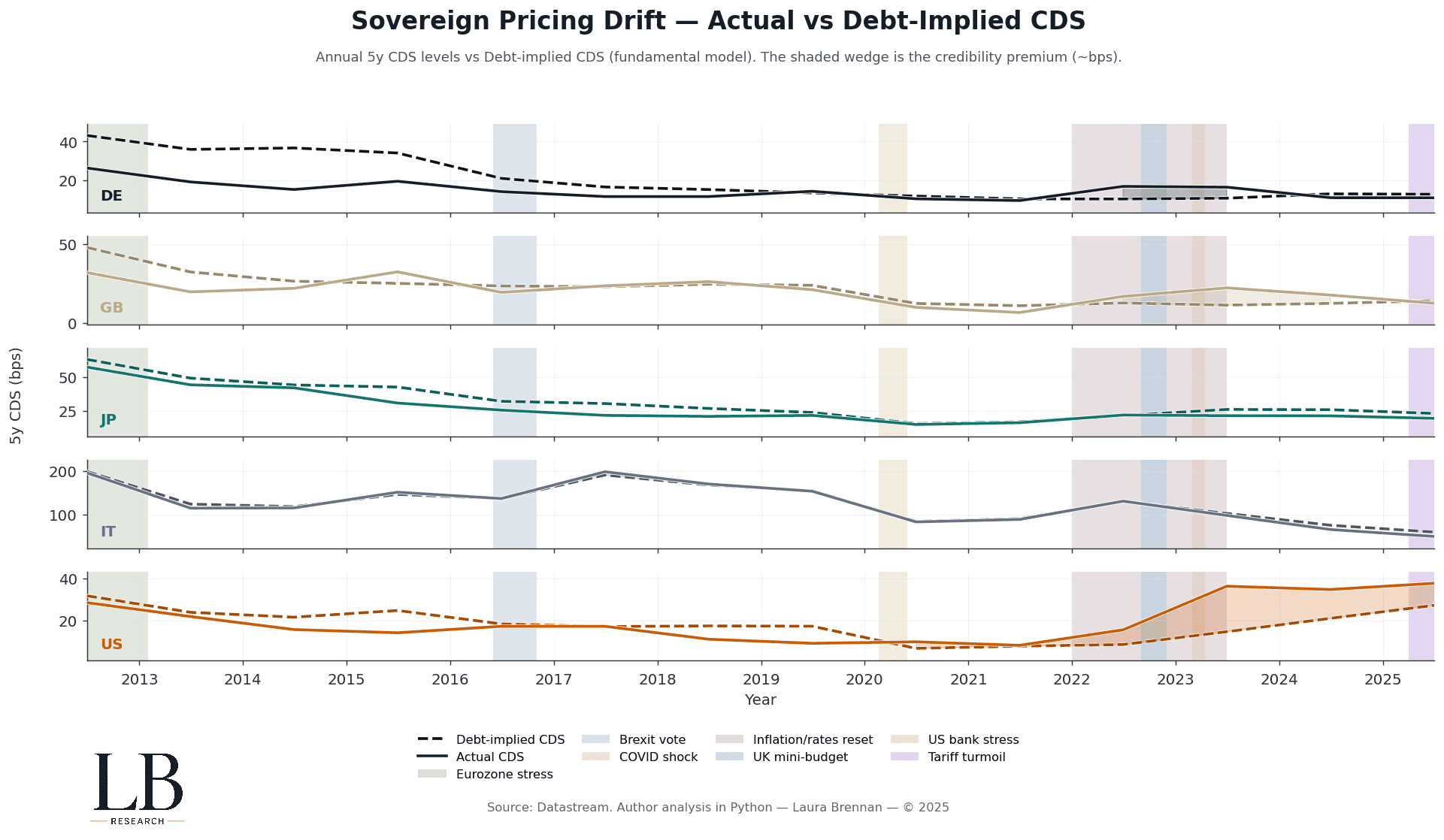

Sovereign Pricing Drift, Actual vs Debt-Implied CDS

This set of five panels places actual CDS spreads against their debt-implied equivalents.

The shaded wedges show the credibility premium in motion, widening through moments of stress, narrowing during calm, and diverging most visibly in periods where fundamentals have no stable anchor.

Notable behaviours:

US CDS rises above model-implied during global stress, reflecting trust as a safe-haven premium rather than weakness.

Italy persistently prices above model-implied spreads, even during periods of global calm.

Germany tracks tightly, signalling stability but no excess trust premium.

Japan shows consistency: low, stable spreads despite high debt, implying long-run structural credibility.

UK credibility eroded materially during the 2022 mini-budget shock and has not fully normalised since.

These divergences illustrate the silent politics inside sovereign pricing models.

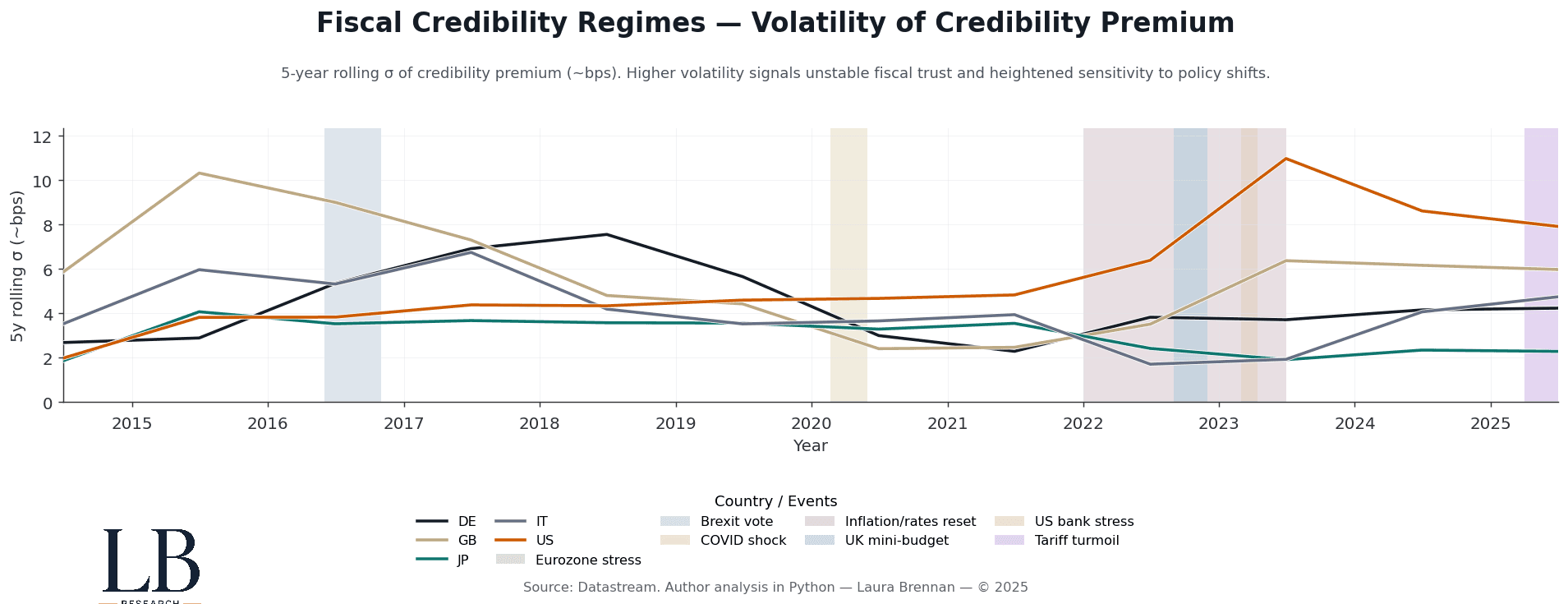

Fiscal Credibility Regimes, Volatility of the Premium

The final figure tracks the 5-year rolling volatility of the credibility premium.

Higher volatility signals unstable fiscal trust; it reflects markets that are increasingly sensitive to noise, rhetoric, and policy pivots.

Key signals:

2022–23 saw the largest volatility spike in over a decade, driven by the global rates reset and domestic fiscal events.

Volatility remains structurally elevated, especially for the US and UK.

Lower-volatility sovereigns (JP, DE) reflect stable expectations rather than strong fundamentals.

Volatility in credibility is the earliest sign that spreads may not widen slowly, they may snap.

What This All Means

Together, these four figures tell a single story:

Credibility is diverging across sovereigns.

Fundamentals explain less than they used to.

Spreads are increasingly governed by trust, not debt ratios.

The system is drifting back toward political valuation regimes.

If credibility frays further, sovereign spreads will not widen in a linear, gentle fashion.

They will reprice in discrete steps.

This is where stress transitions from “quiet repricing” to active fiscal instability.

Method

Rolling pooled OLS (5y):

log(CDS) ~ Debt/GDP + country fixed effectsCredibility premium (bps) = model residual × CDS level

Partial R² = incremental R² of Debt beyond country effects

Data: Datastream

Analysis: Python

Author: Laura Brennan, LB Research

If you want the extended package

LB Research can extend this framework to:

credibility term structures (1y, 5y, 10y CDS residuals)

shock-response matrices for credibility under rates, inflation, or policy events

sovereign regime clustering (structural vs narrative vs mechanical pricing regimes)

cross-asset spillover mapping (rates → FX → CDS → equities)

Tell me what direction you’d like to explore next.