Correlation

Tech Concentration, When Leadership Turns into Load-Bearing

Nov 13, 2025

Tech Concentration, When Leadership Turns into Load-Bearing

A structural read on tech dominance, correlation drift, and the signals that sit beneath headline performance.

Large-cap tech has led the cycle for years.

Leadership itself is not a concern.

What matters is when that leadership becomes structural, and the market begins to rely on a narrow set of names to carry the load.

This Insight studies three layers of that behaviour.

Each highlights a different way concentration builds, stabilises, or breaks.

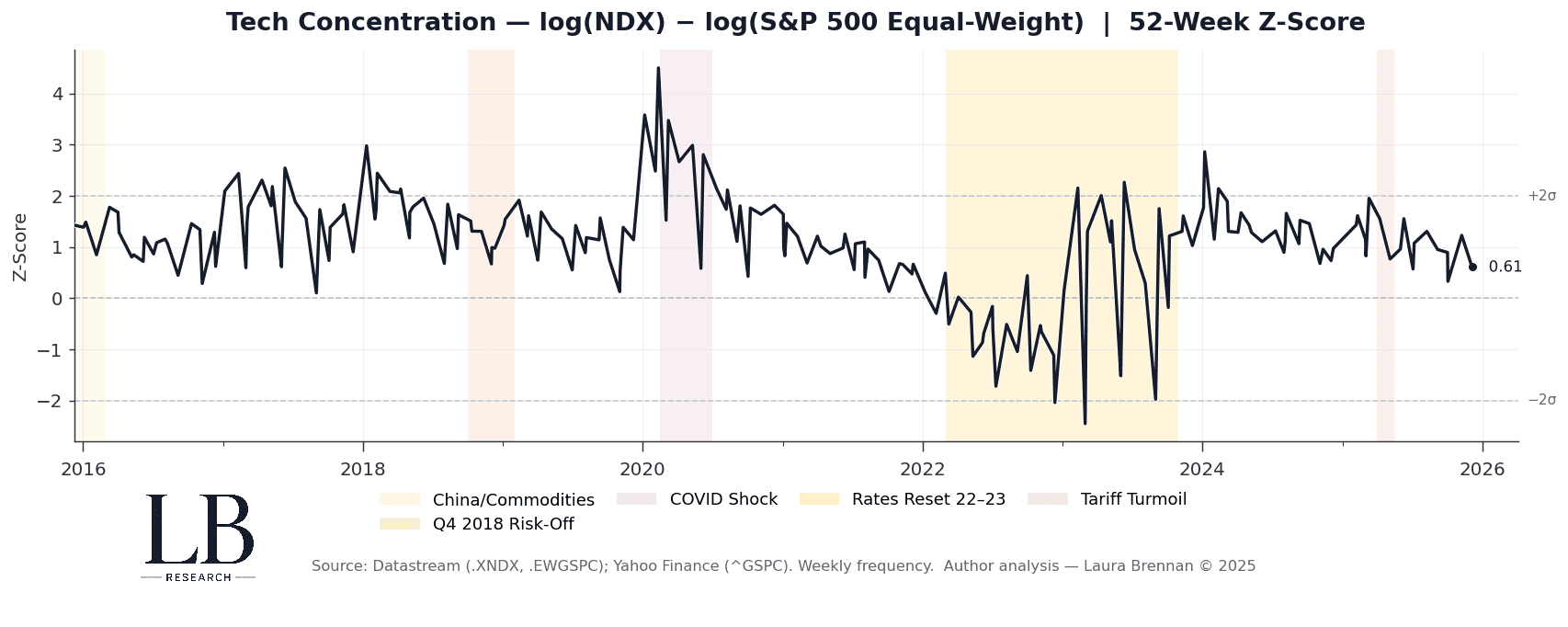

Concentration Spread: log(NDX) − log(S&P 500 EW)

Strong leadership is healthy when the spread oscillates around trend.

It becomes fragile when the spread climbs faster than fundamentals.

Periods such as late-2018, the COVID shock, and the 2022–23 rates reset all show the same pattern:

a forced narrowing of market leadership followed by a violent mean-reversion.

Today the spread remains elevated, but the structure is orderly.

Leadership is firm, not unstable.

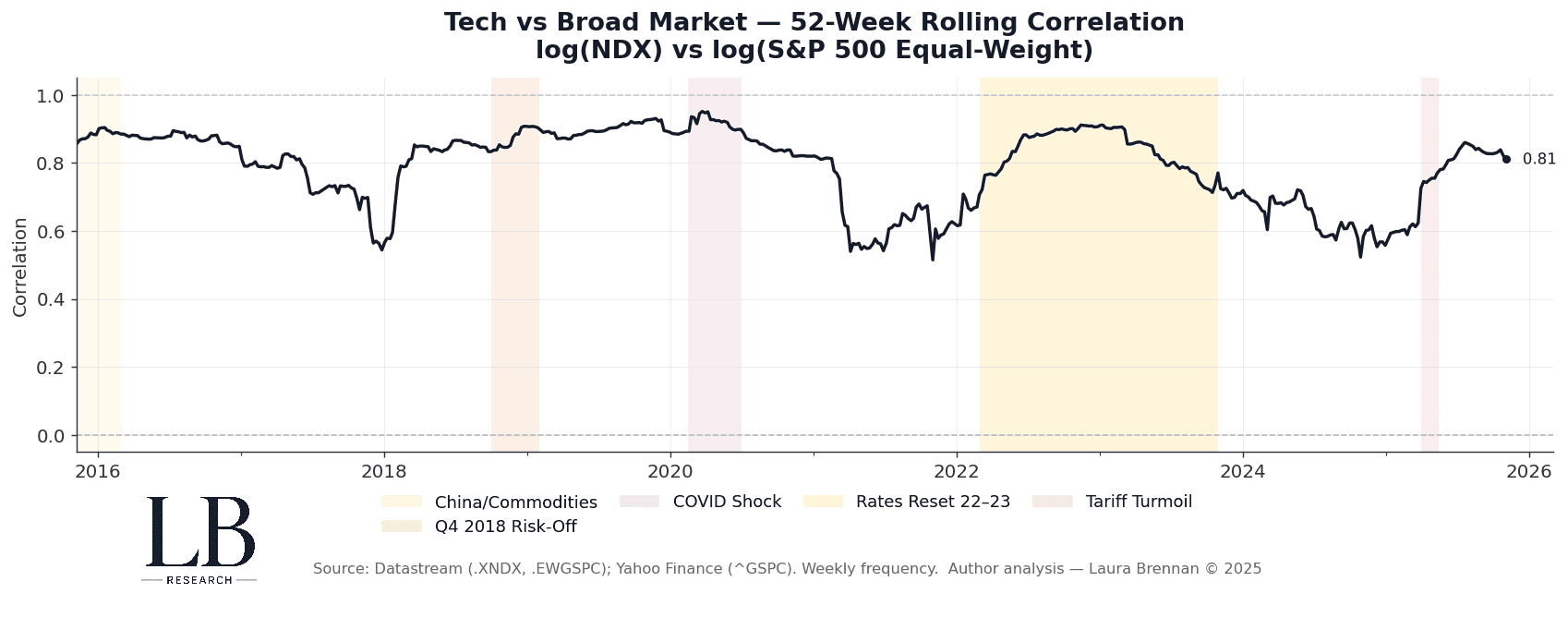

Synchronisation: Tech vs the Broad Market

Tech should move with the market, not apart from it.

High correlation signals a coherent regime.

Falling correlation signals a narrative shift: liquidity stress, macro repricing, or a break in sentiment.

Across the last decade, the market has repeatedly relied on tech to anchor risk.

When that anchor moves, everything else adjusts around it.

Correlation today sits near the top of its range.

Tech is trading as a high-beta version of the macro story, not an unmoored outlier.

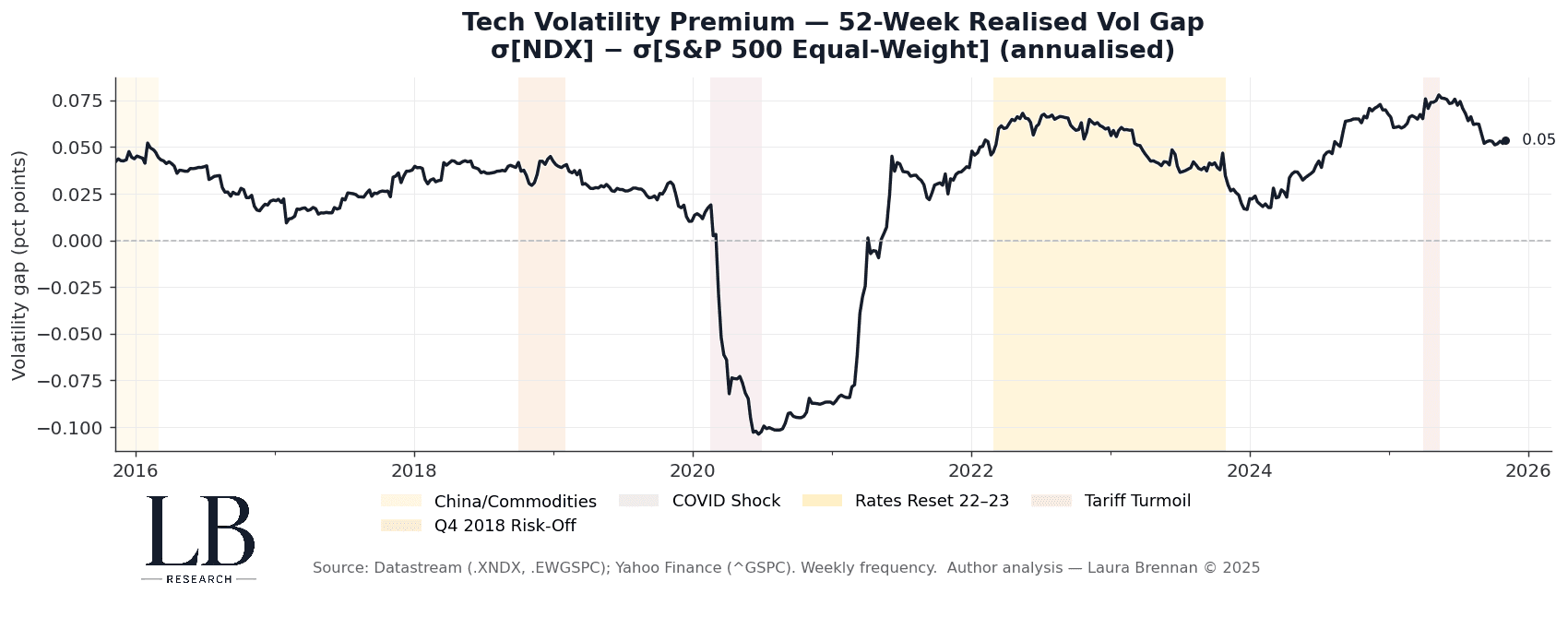

Volatility Premium: σ(NDX) − σ(S&P 500 EW)

The volatility gap shows the cost of concentration.

A positive premium suggests investors are paying up for growth and liquidity.

A negative premium reflects forced positioning or rapid rotation.

The deep negative gap in 2020, and the sharp reset during 2022–23, remain the clearest examples of how quickly leadership can invert when volatility shifts.

The current premium is positive but controlled.

Tech carries risk, but not disorderly risk.

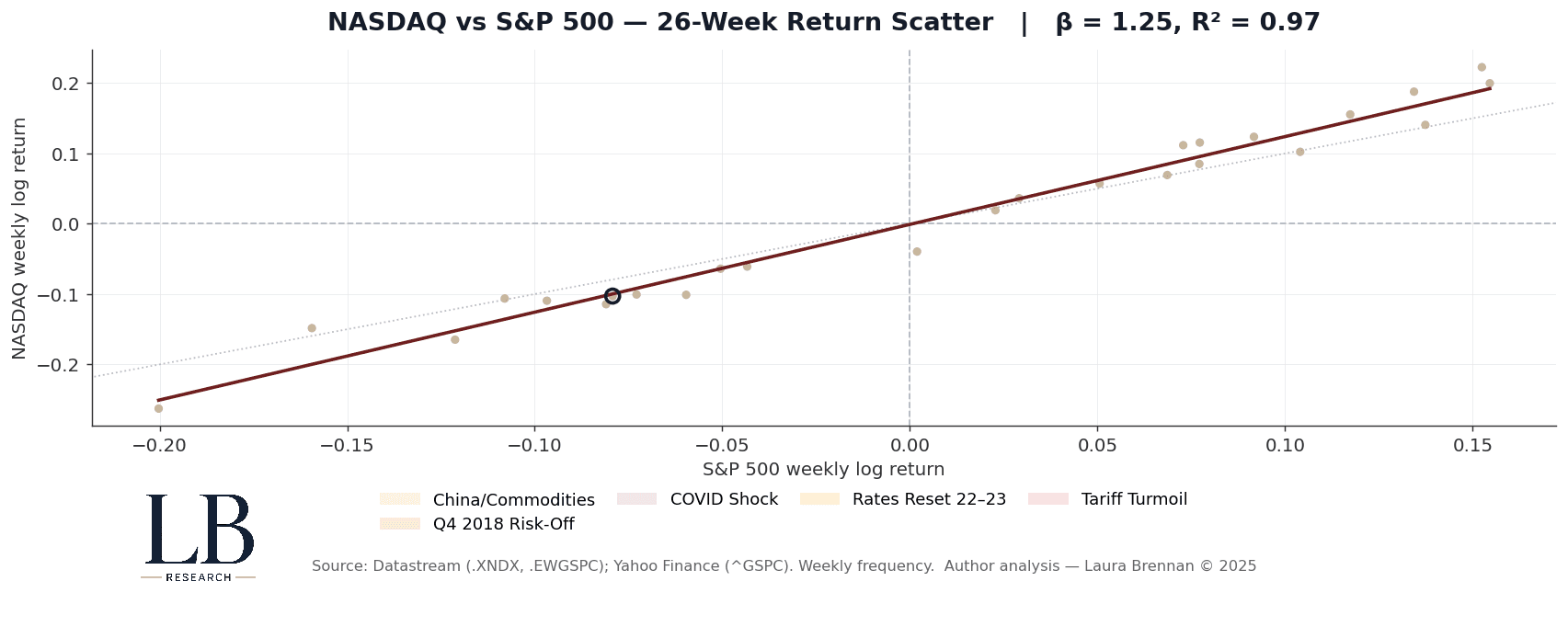

High-Frequency Beta: NASDAQ vs S&P 500

Short-run beta captures investor behaviour at the margin.

The last 26 weeks show:

β ≈ 1.25

R² ≈ 0.97

This is classic late-cycle positioning.

Sensitivity to macro conditions is high, but the relationship remains stable.

Beta spikes with collapsing R² usually mark the end of a regime.

Neither condition is present today.

Where the Structure Stands

Across all three structural indicators, concentration, correlation, and volatility, tech remains the market’s backbone.

The system is leaning on leadership, but the framework is coherent.

Historically, this configuration shifts quickly when macro conditions tighten, which is why I track these signals continuously.

At LB Research, concentration is treated not as a narrative, but as a risk-bearing structure inside the market.

If you’d like the extended package

I can also publish:

a sector-level synchronicity map

a factor-concentration grid

or a fragility sequence showing how narrow markets tip into stress

Just ask, and I’ll produce it.

Enjoyed this Insight?

You can join the LB Research waitlist for early access to structural, cross-asset analysis as soon as it’s released.