Stress Travels, It Doesn’t Jump

Transmission Is Sequential

Markets do not reprice risk everywhere at once.

They transmit it.

Stress tends to move through the system in sequence, not as a single shock.

FX reacts first. Rates adjust next. Equities typically reprice later.

This Insight tracks that transmission path using two views:

correlations, to show ordering

realised volatility, to show timing in levels

Then it adds a third layer that explains why the process accelerates during stress.

Across cycles, the message is consistent:

contagion behaves like a process.

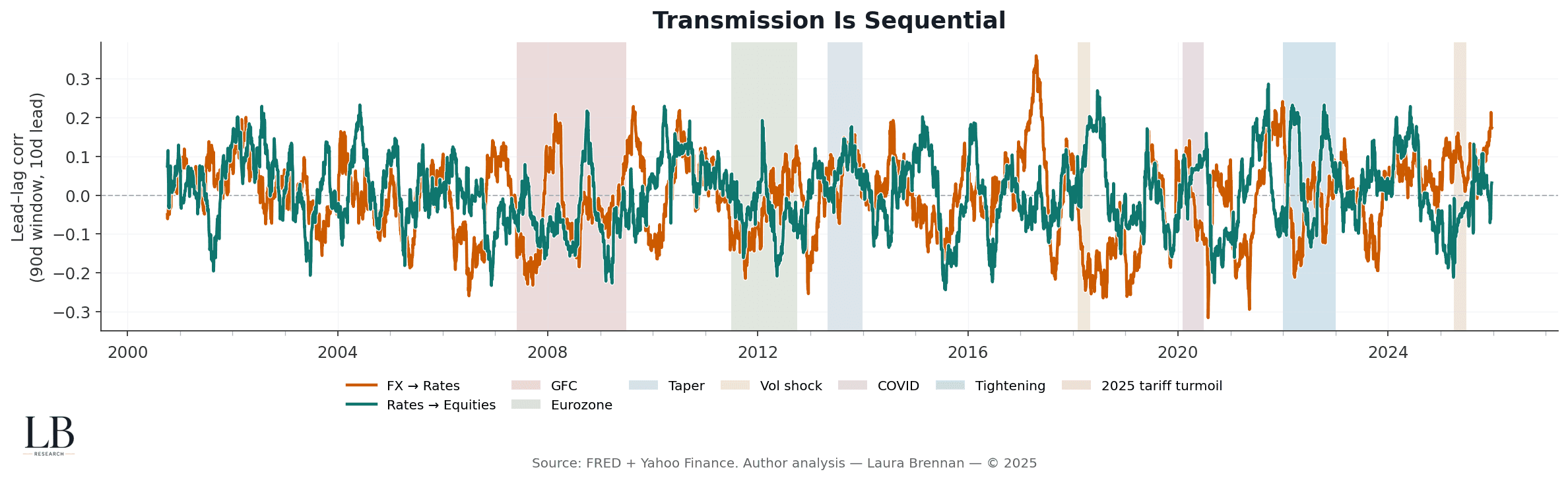

Transmission Is Sequential

Lead–lag rolling correlations

FX → Rates

Rates → Equities

With event bands

This chart tracks lead-lag correlations using a rolling window.

What matters is not the magnitude of correlation on any single day.

It is the ordering.

• FX tends to lead rates when stress starts travelling

• rates then lead equities as the move propagates

• transmission looks sequential even when the narrative is “macro shock”

This reframes contagion as mechanism, not coincidence.

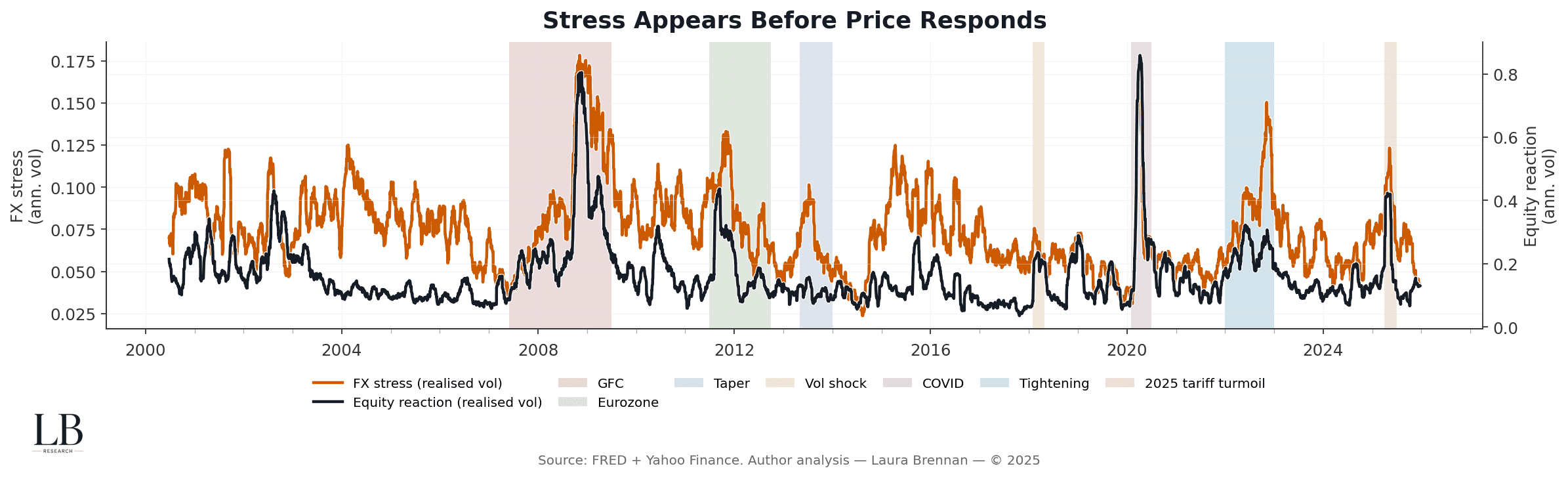

Stress Appears Before Price Responds

FX realised volatility vs equity realised volatility

Same event bands

Two axes, one timing story

Correlations can always be dismissed as “parameter choice”.

So this chart shows the same phenomenon in levels.

• FX volatility often lifts before equity volatility follows

• equity calm can coexist with currency stress for long stretches

• the gap is where positioning tightens without headlines

The first warning rarely arrives in equities.

It appears in funding, currency space, and rates sensitivity.

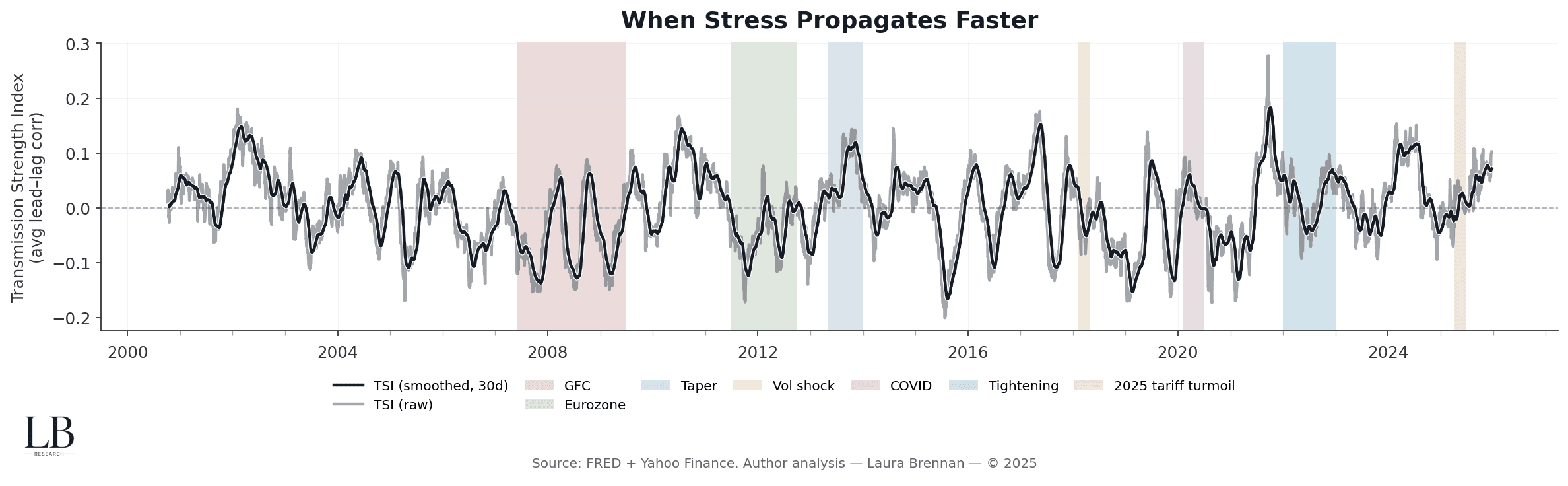

When Stress Propagates Faster

Transmission Strength Index (TSI)

Average of the lead-lag correlations

Smoothed to show regimes

With event bands

This layer explains why models break during transitions.

• transmission strength is not constant

• it clusters and accelerates in stress regimes

• the system shifts from local moves to shared repricing

When TSI rises, the system behaves as a connected mechanism.

Diversification assumptions weaken because linkage tightens.

The Structural Read

Across all three layers, the conclusion is the same:

• stress does not jump, it propagates

• FX often reacts before equity repricing becomes visible

• transmission strength is regime-dependent, not stable

Understanding that sequence matters when reading “calm” periods.

Calm can be delayed repricing, not genuine stability.

Methodology

• Daily data

• FX proxy: DXY returns

• Rates proxy: 10Y yield changes

• Equity proxy: S&P 500 returns

• Lead–lag correlations: 90-day rolling window, 10-day lead

• Realised volatility: 30-day rolling, annualised

• Event windows: major stress regimes for visual alignment

• Sources: FRED and market data

• Analysis: Laura Brennan