The Calendar Illusion

Year-End Does Not Reset Risk

Markets recognise liquidity.

They recognise positioning.

They do not recognise the calendar.

Year-end is often framed as a reset.

In reality, risk carries through the boundary.

This Insight examines what actually happens to rates, credit, equities, and volatility around the turn of the year, using the final trading days of December and the opening days of January, centred on the last December trading session.

Across assets, the message is consistent:

structure persists even when narratives reset.

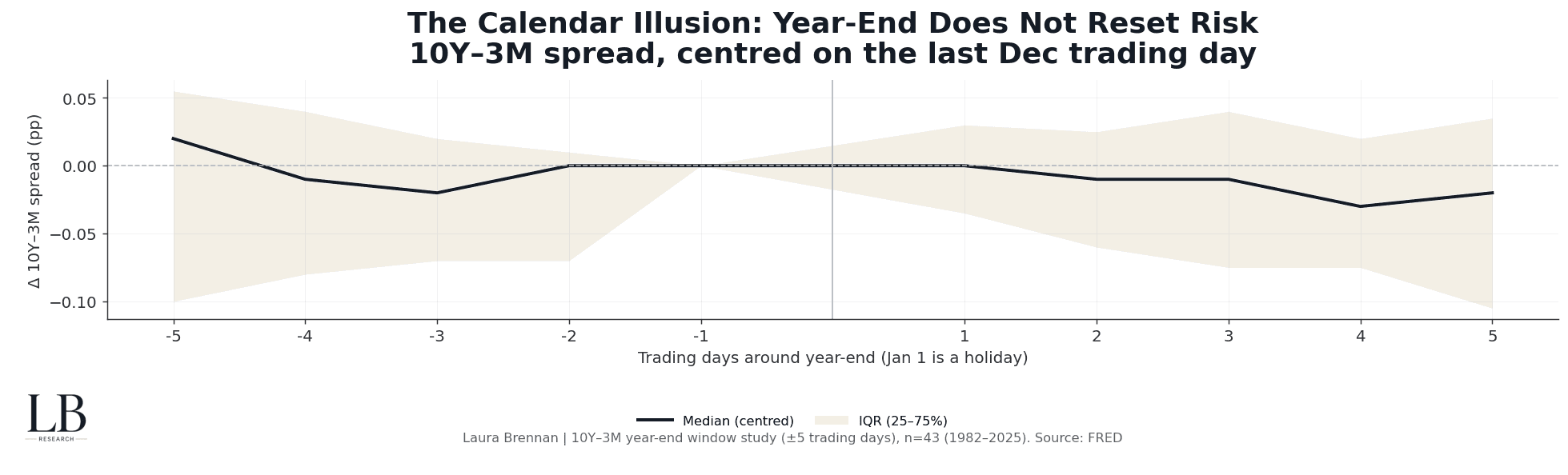

Rates: The Curve Does Not Restart

10Y–3M Treasury Spread

Centred on the last December trading day

This chart tracks the median path and interquartile range of the 10Y–3M spread across 43 year-ends (1982–2025).

What stands out is not volatility, but continuity.

• no discrete jump at year-end

• no structural repricing in early January

• slope dynamics persist across the boundary

If year-end genuinely reset risk, the curve would reflect it immediately.

It does not.

Rates carry their state forward.

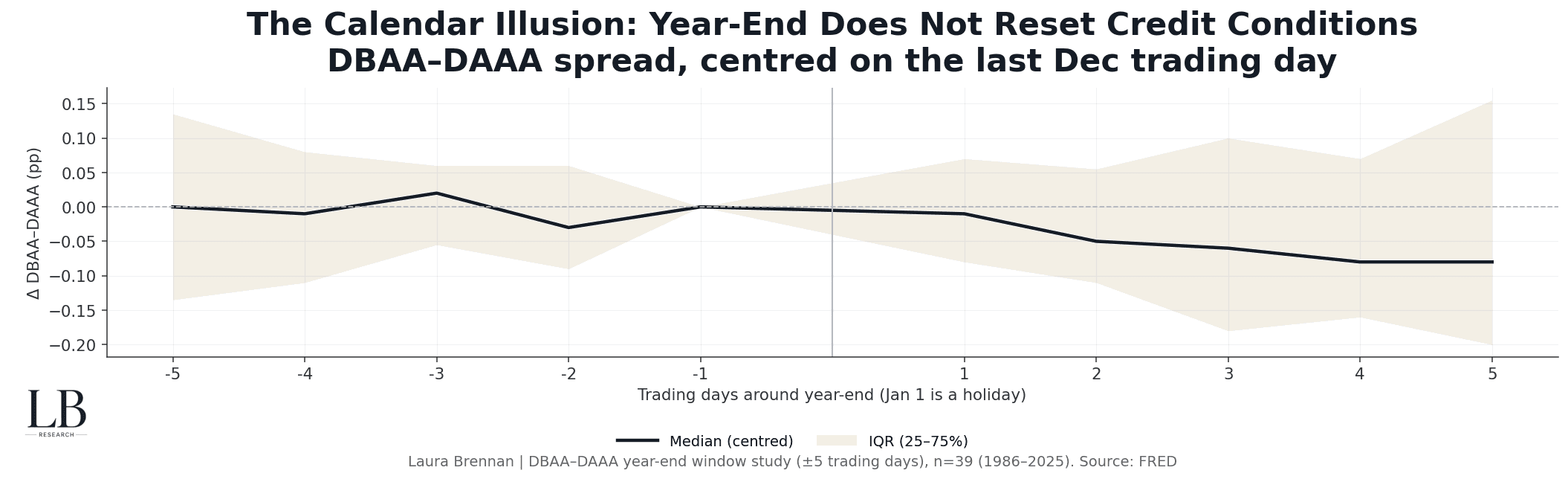

Credit: Stress Does Not Clear on the Calendar

BAA–DAAA Credit Spread

Centred on the last December trading day

Credit markets are even less forgiving of calendar narratives.

Across three decades of data, the BAA–DAAA spread shows:

• gradual evolution rather than reset

• dispersion widening without abrupt repricing

• credit conditions reflecting positioning, not dates

Risk premia do not flush at year-end.

They roll.

Credit remembers what rates try to forget.

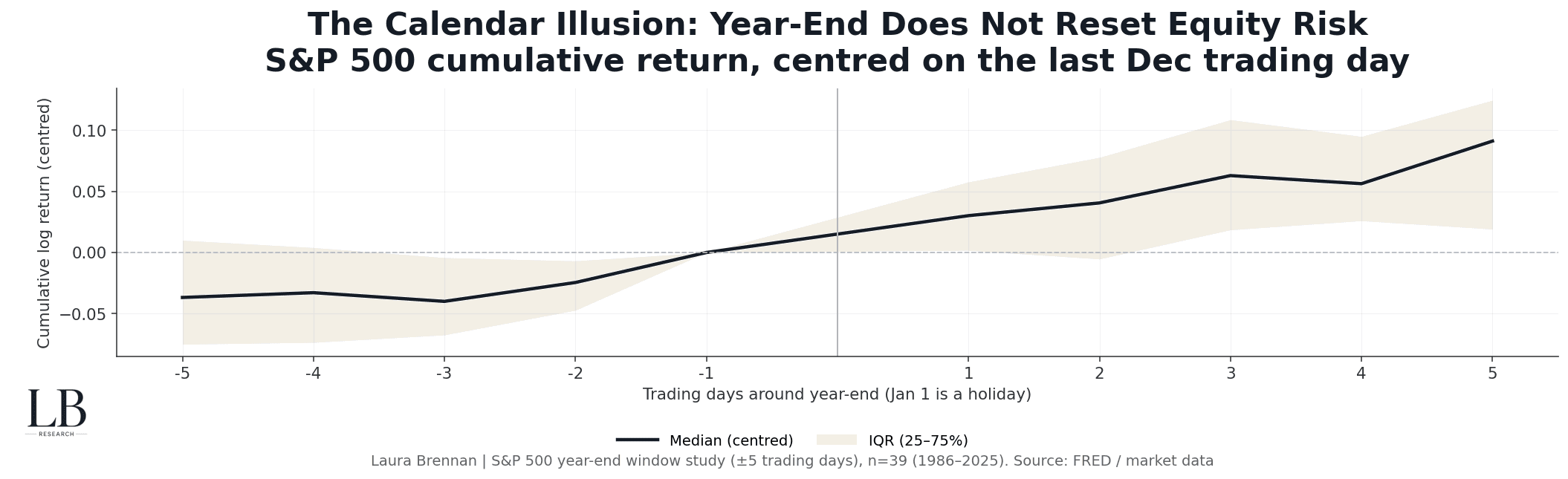

Equities: Performance Resets, Risk Does Not

S&P 500 Cumulative Return

Centred on the last December trading day

Equity returns often appear benign around year-end.

But this chart is centred, not cumulative from January.

That distinction matters.

• returns drift smoothly across the boundary

• no structural break in behaviour

• January strength reflects continuation, not reset

The calendar changes.

The path does not.

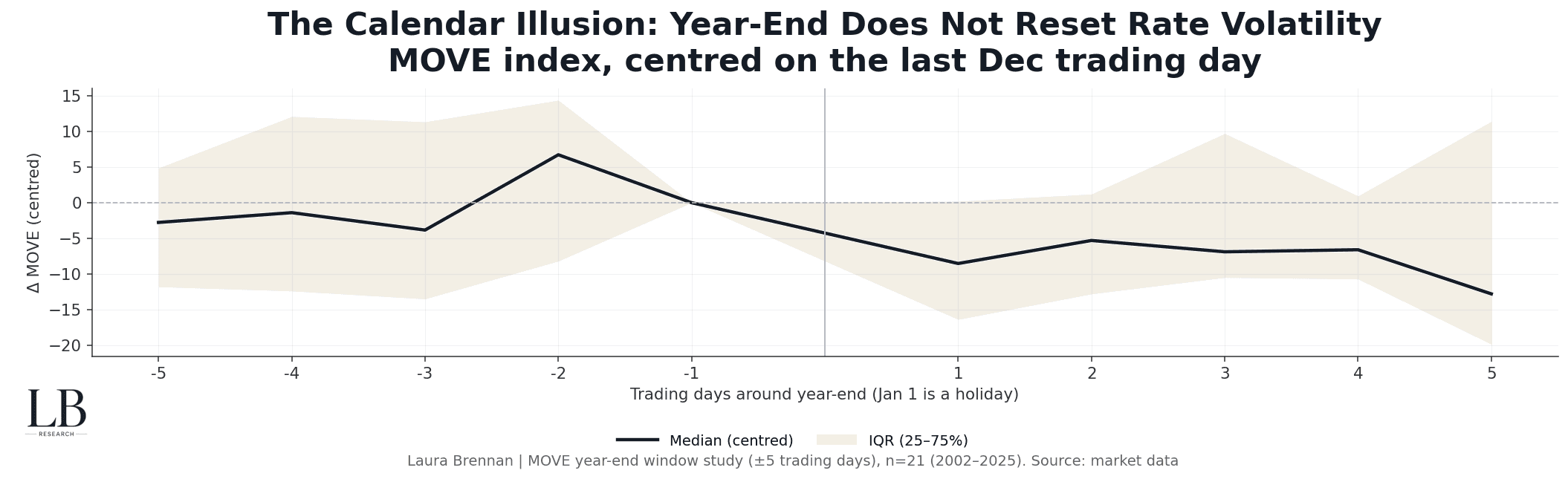

Volatility: Calm Does Not Mean Neutral

MOVE Index

Centred on the last December trading day

Rates volatility is the clearest reminder that risk does not reset.

Across two decades of MOVE data:

• volatility often falls into January

• dispersion remains wide

• stress decays unevenly, not symmetrically

Volatility does not vanish.

It re-prices on its own schedule.

Quiet does not mean neutral.

It means absorbed.

The Structural Read

Across all four layers, rates, credit, equities, volatility, the conclusion is the same:

• the calendar changes faster than risk

• narratives reset before positioning does

• structural conditions persist through year-end

January is not a clean slate.

It is a continuation point.

Understanding that distinction matters when interpreting early-year calm, rebounds, or drawdowns.

Risk does not reset.

It carries memory.

Methodology

• Daily data, multi-decade samples

• ±5 trading-day windows around year-end

• Series centred on the final December trading day

• Median paths with interquartile ranges

• Sources: FRED, market data

• Analysis: Laura Brennan